Tell us what happened. Get started on usaa.com or the USAA Mobile App.

How renters claims work

We’ll help you with every step of your claim and provide personalized updates along the way.

Steps to complete How renters claims work

What you’ll need to file a claim

Give as much information as you can to help us process your claim, including:

- Photos of the damage.

- Receipts for any temporary repairs needed to prevent more damage.

- List of damaged items including brands and models.

- Proofs of purchase for damaged belongings, if available.

Should you file a renters claim?

You should always tell us about damage to your things. If you’re not sure what’s covered, you can check your policy.

It’s important to file a claim if:

- The cost of the damage to your belongings is more than your deductible.

- Living in your home is unsafe.

- You damaged someone else’s property.

- Someone else is responsible for the accident.

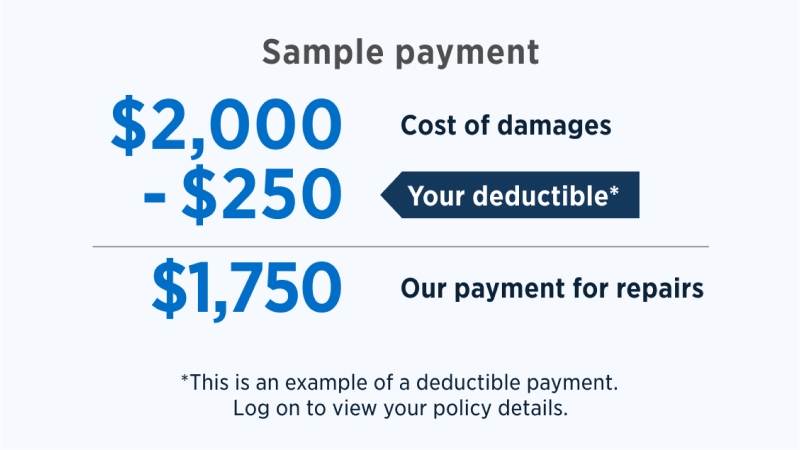

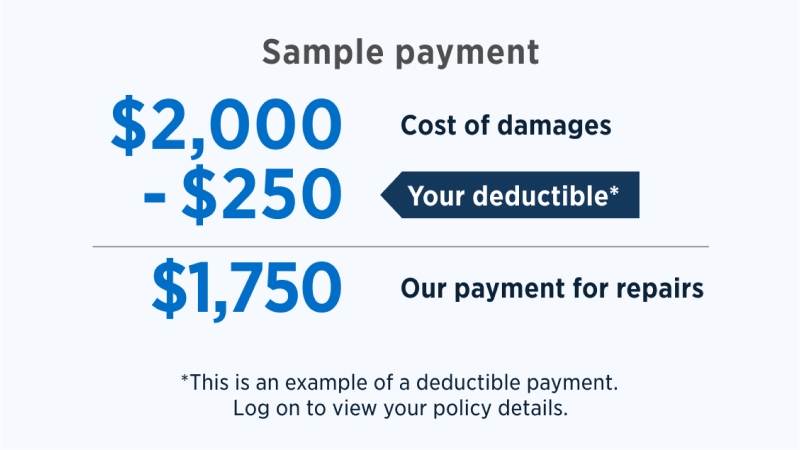

How renters deductibles work

Your deductible is the out-of-pocket amount you'll pay for repairs or to replace items on a covered claim.

For example, if damages or stolen items cost $2,000 and your deductible is $250, then we would pay $1,750 to replace your things.

You can find your deductible on your renters policy.

Renters insurance claims FAQ

It depends. The cost of repairing or replacing damaged items and your claims history are some of the factors that can affect your premium.

For example, if the price of new furniture, electronics or clothing has gone up, it could impact your premium. We won't know if there are any changes until your policy is up for renewal.

It depends on the circumstances and the complexity of your claim.

Several factors can affect how long your claim takes, including:

- The amount of damage.

- How much information you provide.

No, unless they’re related to you. Roommates will need their own policy to protect their things.

Still need help?

If you can’t find the information you need, give us a call at 800-531-USAA (8722).