Get to know USAA.

Choose an era to learn how our mission shaped our past and drives our future.

The beginning of our journey

From the start, we’ve been relentlessly focused on serving those who serve our country. Our organization was formed to meet the unique needs of the military.

The founding

On June 20, 1922, a group of Army officers met at the Gunter Hotel in San Antonio to create what would become known as the United Services Automobile Association.

At the time, auto insurance companies considered military officers to be high-risk customers. So they decided to team up and provide insurance for each other.

Our first president

After deciding to form the company, the founders elected a board of directors. They chose Major William H. Garrison as their first president.

And in the following days, they hired Harold Dunton as the first employee, a general manager.

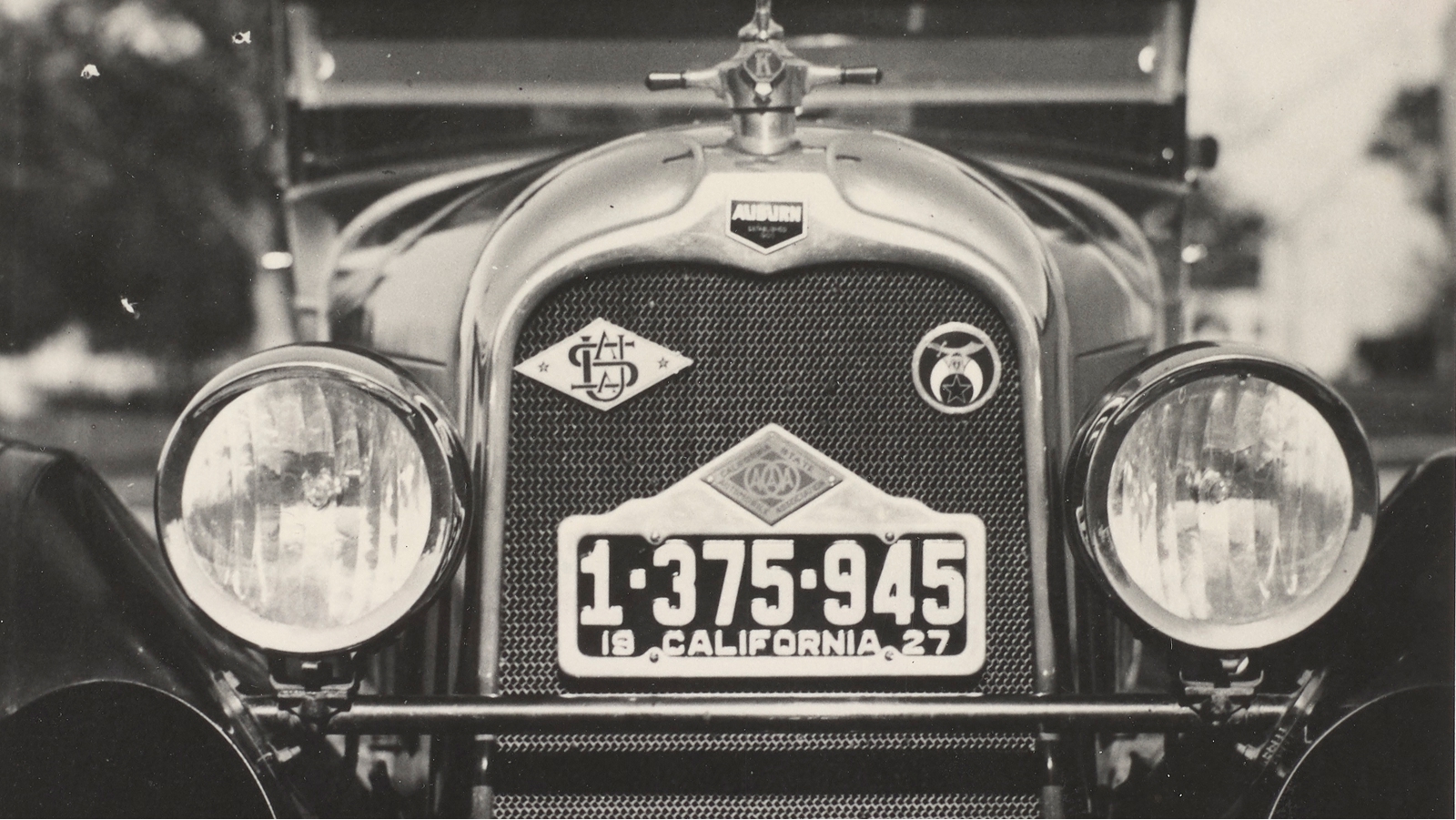

Our first member

On June 23, 1922, Major Walter Moore bought the first USAA auto insurance policy for his 1922 Elcar. The annual premium was $114.47.

Eligibility expands

In 1923, we opened membership to Navy and Marine Corps officers, reaching more of the military community.

Growing through tough times

We leaned on our culture to withstand the challenges of the Great Depression and World War II.

With integrity and purpose, we adapted to the unique needs of our members.

Membership doubles

In 1932, we published our first annual report to members. It showed a successful year in 1931 despite a global economic depression.

Membership doubled to 30,000, and net revenues and dividends increased.

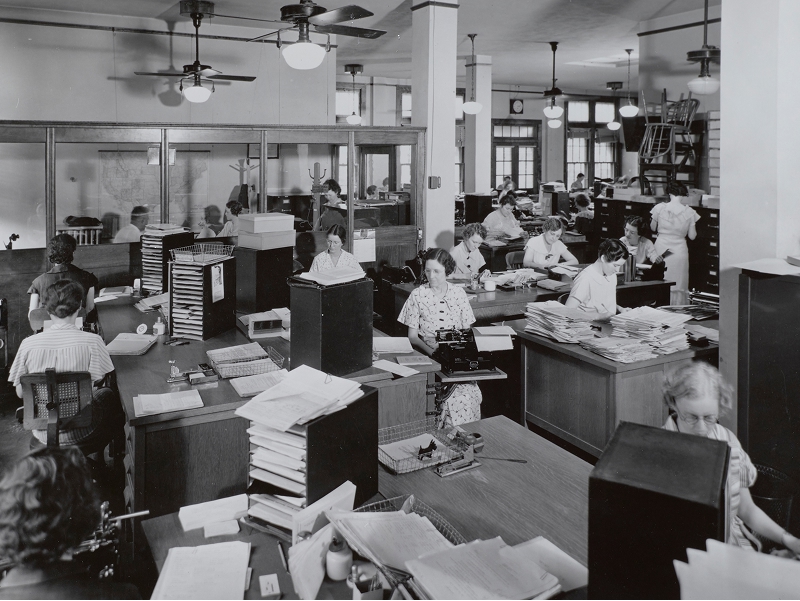

Paving the way

In 1924, Stuart Cochran Gwyn joined the company. At first, she assessed member risk and handled auto correspondence.

Ten years later, she became USAA's Chief Underwriter and the first woman to join the management team.

Wartime efforts

One day after the attack on Pearl Harbor, we automatically renewed policies for members deployed outside the continental U.S.

This helped to ease the burden on those who served abroad during World War II.

Continuing to expand membership

In the 1930s, we opened membership to service academy cadets, Foreign Service Officers and unremarried widows.

The following decade, we grew to include commissioned and warrant officers from the U.S. Air Force, which was established in 1947.

Expansion and innovation

Our organization flourished as we focused on operational excellence.

The growth led to more offices, new technology and more products for members.

Offices abroad and at home

In 1952, we opened our first European office in Frankfurt, Germany.

Ten years later, we started the American Officers Insurance Company in London to provide insurance to members in the U.K.

Then in the 1970s, we expanded within the U.S. by opening several offices in regions around the country.

Breaking down barriers

Consuelo Kerford, Vice President-Secretary, became the company’s first female executive officer in 1956.

This highlighted our longstanding commitment to a more integrated workforce.

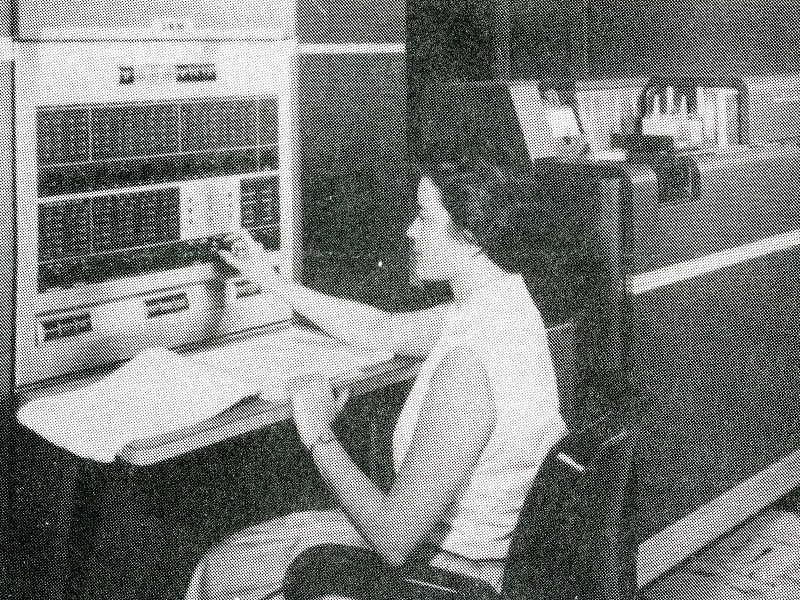

Leveraging new technology

We installed our first computer, an IBM 650, in 1957.

Over 20 years later, we introduced a toll-free phone service for policyholders across the contiguous 48 states.

Standing strong against Hurricane Camille

In 1969, we formed a special task force to handle the crisis response to Hurricane Camille.

They worked on an almost continuous basis for 2 weeks to handle 340 auto and 140 fire and marine claims.

By the end of the year, we had processed 891 claims related to Camille that totaled nearly $1 million.

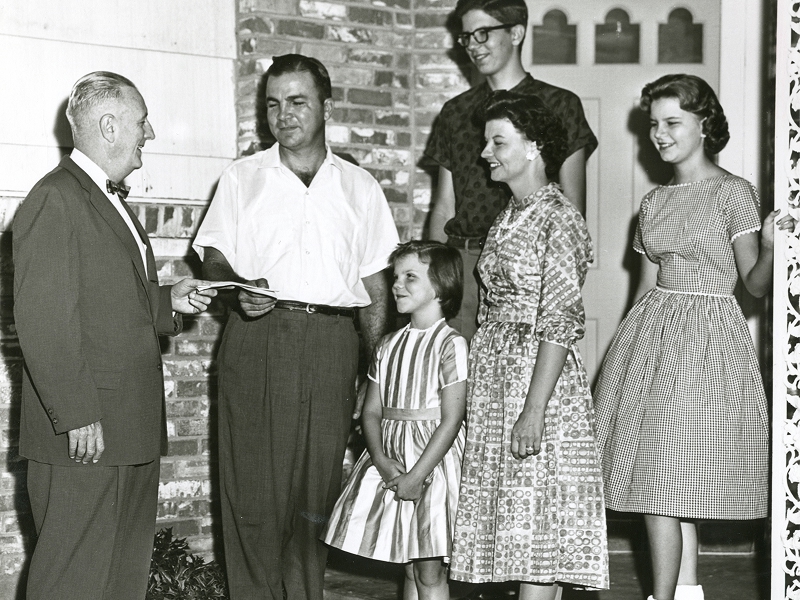

Home and life insurance

In 1960, we started offering homeowners insurance to members. Then three years later, we launched the Life Company to add life insurance to our growing suite of products.

Embracing modernization

The 1980s and 90s were marked by considerable change. We improved advocacy and introduced new financial services that improved how members could interact with us online.

More services for members

In 1983, we launched USAA Buying Services and started the USAA Federal Savings Bank.

Then in 1989, we launched the USAA Educational Foundation, in part, to help military families manage their money.

Empowering employees to give back

We created the USAA Volunteer Corps in 1983 to help organize and encourage employees to volunteer in their communities.

Then in 1994, we formed the USAA Foundation, a charitable trust, to support nonprofits.

Roadside and travel assistance

In 1991, we launched the USAA Road and Travel Plan. This provided emergency roadside assistance and travel benefits to members.

Welcoming the enlisted

In 1995, we expanded membership to enlisted personnel. The first policy was sold to Army Master Sgt. Carol Haskins for her 1989 Toyota MR2.

Launch of usaa.com

In 1999, we launched our website, usaa.com, to make it easier for members to engage with us. It also allowed members to buy and manage our products and services online.

Building for the future

We’re always improving to meet our members' changing needs. And we strive to remain a leading provider of financial services for our over 13 million members.

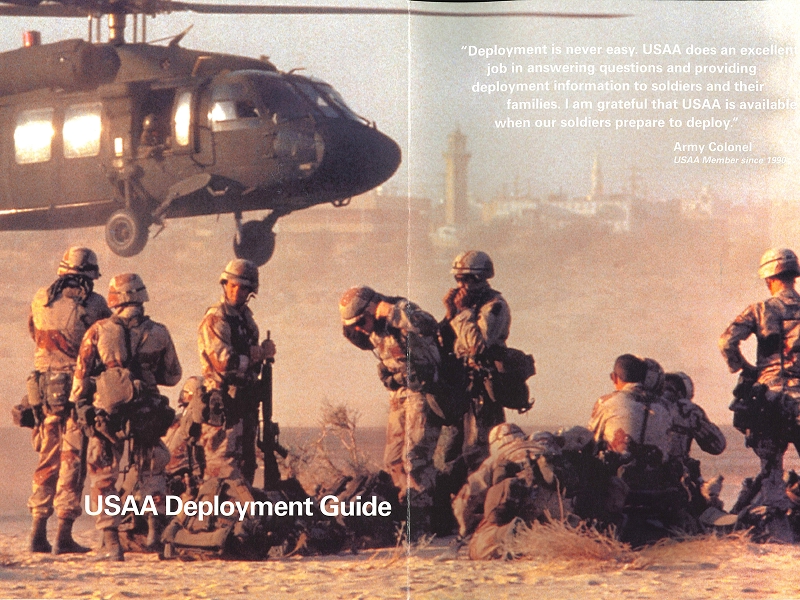

Special deployment assistance

In 2001, we provided special deployment assistance to members called on to respond to the fight against terrorism.

Launch of the USAA Mobile App and more

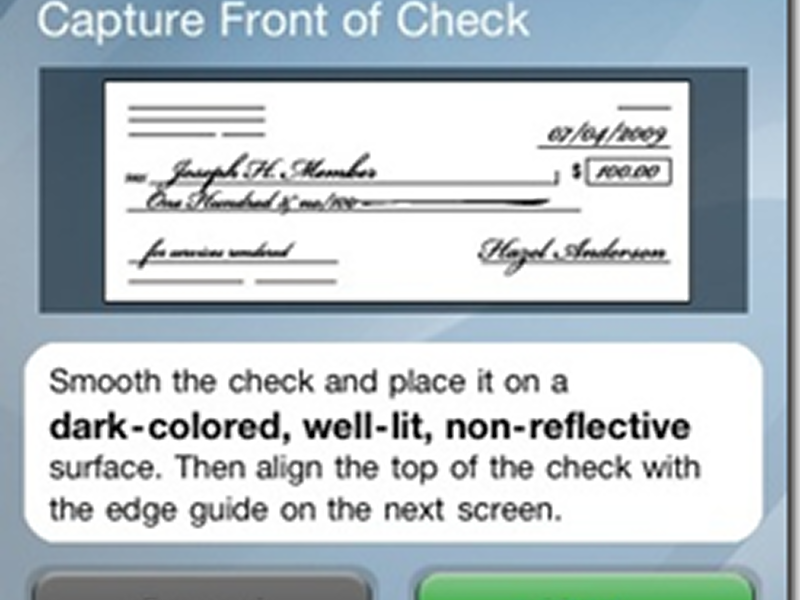

In 2006, we became the first company to allow members to deposit checks from wherever they are. They just needed an internet connection and a scanner.

Then in 2009, we launched our mobile app, and a year later introduced it for the iPad®. This helped members manage their finances and access advice on the go.

Serving the whole military community

In 2009, we opened membership to all men and women who are serving or have honorably served in the U.S. military, along with their families.

100 years of service

In 2022, we celebrated our 100-year anniversary, marking a century of service to the military community.

Expanding advocacy

In 2025, we expanded our outreach efforts to support the military community in three key areas:

- Meaningful careers

- Financial security

- Well-being